融誉100金融品牌怎么样 申请店铺

外推网助力融誉100金融品牌出海!将品牌入驻外推网,定制融誉100金融品牌推广信息,可以显著提高融誉100金融产品曝光,简直是跨境电商爆单神器!目前仅需1000元/年哦~

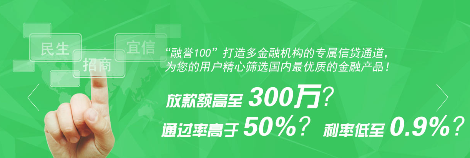

融誉100是上海融行信息技术有限公司旗下的金融信息管理与服务平台,中国小微金融服务的领跑者。融誉100面向全国4800万家中小微企业提供以“增信服务”为核心的互联网金融信息服务,帮助它们以便捷的方式、更短的周期、合理的利率,通过最匹配的金融机构获得信贷服务,为广大中小微企业的经营和发展提供宝贵的资金支持,从而帮助它们实现企业经营的成功。

2013年11月,上海融行信息技术有限公司在上海自贸区正式成立,成为试水中国新一轮经济改革的先行者。目前,融誉100金融信息服务平台已经与多家银行等信贷服务机构建立了正式合作关系,与全国逾数百家中小微企业网络服务商及第三方认证机构开展密切合作,间接拥有超过数千人的服务终端人员,在几个月时间里已帮助近几千家中小微企业获得授信或放款。

4800万家中小微企业是推动中国经济增长的生力军,贡献了60%以上的GDP、50%以上的税收和80%以上的就业岗位。然而,中小微企业所获得的金融资源与其贡献的社会价值相比,是极不相称的。目前,全国90%以上的中小微企业都还没有和金融机构产生任何借贷关系,社会贷款总额仅有10%流向了中小微企业,低成本、便捷地获得金融资源支持已经成为广大中小微企业在经营发展中最急迫的需求之一。

作为小微金融服务的领跑者,积极响应国务院“大力发展中小微金融”、和“着力强化对中小微企业的增信服务和信息服务”伟大号召,为广大中小微企业——尤其是网商企业——提供专业的增信服务,输送宝贵的资金血液,帮助它们取得企业经营的成功,这是融誉100光荣而神圣的使命!

作为托管中小微企业信用档案的中枢环节,融誉100有机地整合了上游金融机构资源和下游中小微企业需求,地打通了金融贷款服务所需的信息流、服务流和资金流。通过网络与电商服务商、第三方认证机构和企业信息化服务商以及互联网便捷地获取全国中小微企业的资质、电子商务经营现状和贷款融资需求,借助大数据分析手段及专业的信用评估和定级模型为相关企业建立和托管信用档案,并与匹配的金融机构进行对接,降低其获取和评估信贷客户的难度和成本,从而帮助相关企业在更短的周期内便捷且低成本地获得信贷支持。

Rongyu 100 is the financial information management and service platform of Shanghai Ronghang Information Technology Co., Ltd. and the leader of small and micro financial services in China. Rongyu 100 provides Internet financial information services with "credit enhancement service" as the core for 48 million small and medium-sized micro enterprises across the country. It helps them to obtain credit services through the most matching financial institutions in a convenient way, a shorter cycle and a reasonable interest rate, and provides valuable financial support for the operation and development of the majority of small and medium-sized micro enterprises, so as to help them achieve the success of business operation Work. In November 2013, Shanghai Ronghang Information Technology Co., Ltd. was officially established in Shanghai Free Trade Zone, becoming the forerunner of a new round of economic reform in China. At present, the financial information service platform of Rongyu 100 has established formal cooperative relations with a number of banks and other credit service institutions, and has carried out close cooperation with more than hundreds of small and medium-sized micro enterprise network service providers and third-party certification institutions across the country. It indirectly has more than thousands of service terminal personnel, and has helped nearly thousands of small and medium-sized micro enterprises obtain credit or loan in a few months. 48 million small and medium-sized enterprises are the new force to promote China's economic growth, contributing more than 60% of GDP, more than 50% of taxes and more than 80% of jobs. However, the financial resources obtained by small and medium-sized micro enterprises are not commensurate with the social value they contribute. At present, more than 90% of small and medium-sized enterprises in China have not had any loan relationship with financial institutions. Only 10% of the total social loans flow to small and medium-sized enterprises. Low-cost and convenient access to financial resources support has become one of the most urgent needs of the majority of small and medium-sized enterprises in the operation and development. As a leader in small and micro financial services, we actively respond to the great call of the State Council to "vigorously develop small and medium-sized micro finance" and "strive to strengthen credit enhancement services and information services for small and medium-sized micro enterprises", provide professional credit enhancement services for the majority of small and medium-sized micro enterprises, especially for online business enterprises, transport valuable capital blood, and help them to achieve business success. This is financing Honor 100 glorious and sacred mission! As the central link of Trusteeship of credit files of small and medium-sized enterprises, Rongyu 100 organically integrates the resources of upstream financial institutions and the needs of downstream small and medium-sized enterprises, and gets through the information flow, service flow and capital flow needed for financial loan services. Through the network and e-commerce service providers, third-party certification institutions and enterprise information service providers, as well as the Internet, it is convenient to obtain the qualification, e-commerce business status and loan financing needs of small and medium-sized micro enterprises in China. With the help of big data analysis methods and professional credit evaluation and rating models, it establishes and trusteers credit files for relevant enterprises, and connects with matching financial institutions to reduce It reduces the difficulty and cost of obtaining and evaluating credit customers, so as to help related enterprises obtain credit support conveniently and cheaply in a shorter cycle.

本文链接: https://brand.waitui.com/c56b438d4.html 联系电话:请联系客服添加 联系邮箱:请联系客服添加

浙公网安备 33011802001999号

浙公网安备 33011802001999号